At Inman Connect Las Vegas, July 30-Aug. 1 2024, the noise and misinformation will be banished, all your big questions will be answered, and new business opportunities will be revealed. Join us.

After holding steady for two weeks, mortgage rates look poised to resume a pullback from 2024 highs, after the Federal Reserve’s preferred measure of inflation fell for the third month in a row.

TAKE THE INMAN INTEL INDEX SURVEY FOR JULY

The personal consumption expenditures (PCE) price index fell to 2.51 percent in June from a year ago, just half a percentage above the Fed’s 2 percent target, the Commerce Department’s Bureau of Economic Analysis reported Friday.

Core PCE, which excludes the cost of food and energy and can be a more reliable indicator of underlying inflation trends, was up 2.63 percent from a year ago, essentially flat from May.

PCE and Core PCE trending down

“We see a decent chance that core PCE hits 2 percent in the middle of next year, much sooner than the Fed’s forecast,” Pantheon Macroeconomics Chief Economist Ian Shepherdson said in a note to clients. Projections issued by Fed policymakers in June showed they didn’t expect inflation to hit 2 percent until 2026.

Ian Shepherdson

“If we’re right, the clear and obvious progress towards the target across [the second half of 2024], coupled with a loosening of the labor market, will push the Fed into easing much more quickly than their current forecasts,” Shepherdson predicted.

Pantheon Macroeconomics is predicting the Fed will cut short-term interest rates by 1.25 percentage points this year, starting with a 25 basis-point cut in September, followed by 50 basis-point reductions in November and December. A basis point is one-hundredth of a percentage point.

That would bring the federal funds rate to between 4 percent and 4.25 percent, down from the current target of 5.25 percent to 5.50 percent.

Futures markets tracked by the CME FedWatch Tool show investors aren’t anticipating the Fed will cut that drastically. As of Friday, futures markets investors put the odds that the Fed will cut rates by at least 75 basis points this year at 65 percent, and only about a 7 percent chance for deeper cuts.

The latest PCE data came on the heels of a surprisingly strong gross domestic product (GDP) report released Thursday. The advance estimate from the Bureau of Economic Analysis put second-quarter GDP growth at 2.8 percent, up from 1.4 percent in Q1.

That rate of growth “was undeniably robust, easily beating both our own and the consensus forecasts,” economists at Pantheon said in their July 26 U.S. Economic Monitor. “Looking under the hood, however, we see good reasons to think this strength will be short-lived.”

The biggest driver of Q2 GDP was stronger than expected government spending, Pantheon economists said, which “looks unlikely to be repeated, given the pressure that much weaker revenue growth is putting on state and local government finances.”

Yields on 10-year Treasury notes, a barometer for mortgage rates, dropped 6 basis points Friday after the release of the June PCE price index. Treasury yields had climbed by about the same amount Thursday on the strong GDP report.

Rates for 30-year fixed-rate conforming mortgages averaged 6.77 percent Thursday, down half a percentage point from a 2024 high of 7.27 percent registered on April 25, according to rate lock data tracked by Optimal Blue.

A survey by Mortgage News Daily showed rates on 30-year fixed-rate mortgages were down 5 basis points Friday, back to about where they were a week ago.

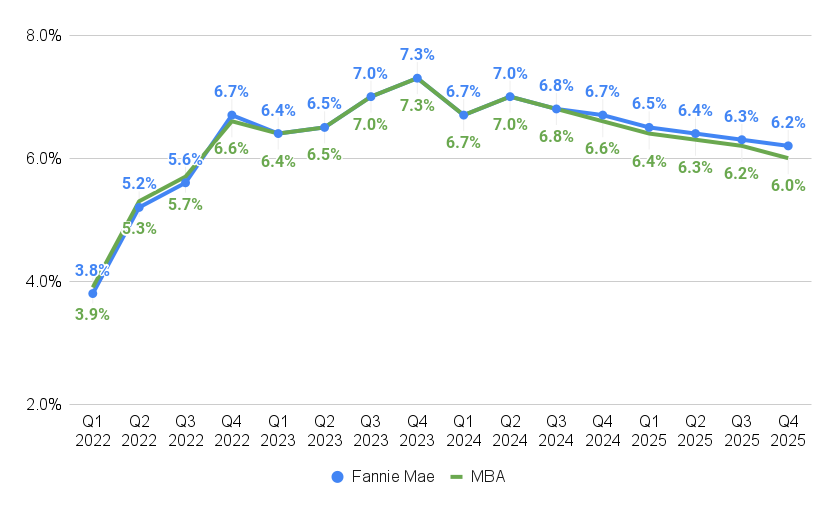

Economists at Fannie Mae and the Mortgage Bankers Association (MBA) predict mortgage rates will continue to drop into the low sixes by the end of next year.

Mortgage rates projected to ease

Source: Fannie Mae and Mortgage Bankers Association forecasts, July 2024.

The recent decline in mortgage rates hasn’t sparked a rush to buy homes, with a weekly MBA survey of lenders showing requests for purchase loans fell by a seasonally adjusted 4 percent during the week ending July 19 when compared to the week before, and was off 15 percent from a year ago.

A series of encouraging consumer price index (CPI) reports have also raised expectations that the Fed will ease, although Federal Reserve Chair Jerome Powell and other policymakers at the central bank have consistently warned that they won’t cut rates until they’re convinced inflation has truly been tamed.

That was the gist of remarks Fed Governor Christopher Waller made on July 17, following the release of a CPI report showing price appreciation cooled to 3 percent annually in June.

Christopher Waller

“On the one hand, it is essential that monetary policy get inflation down to a sustained level of 2 percent,” Waller said. “If we start to loosen policy too soon, and allow inflation to flare up again, we risk losing credibility with the public and allowing expectations of future inflation to become unanchored.”

The credibility the Fed has gained by keeping rates elevated “has helped inflation fall as quickly as it has in the past 18 months and squandering it would be a grave mistake,” Waller said. “Monthly PCE inflation has very recently been running near 2 percent at an annual rate, but I need to see a bit more evidence that this will be sustained.”

Waller also acknowledged that there’s also a risk that if the Fed waits too long to cut rates, that could contribute to “a significant economic slowdown or a recession, with unemployment rising notably.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.