HAPPENING NOW! At Inman Connect Las Vegas, July 30-Aug. 1, 2024, the noise and misinformation will be banished, all your big questions will be answered, and new business opportunities will be revealed. JOIN US VIRTUALLY.

Although they helped nearly 800,000 Americans buy a home in 2023, private mortgage insurers lost market share to FHA and VA programs last year — a trend that continued into the first quarter of 2024.

In the wake of the 2007-09 housing crash and Great Recession, FHA or VA loans were often the best bet for many homebuyers who hadn’t saved up much for a down payment.

But private mortgage insurers — who provide a backup to lenders that’s required by Fannie Mae and Freddie Mac when homebuyers put less than 20 percent down — have been working to claw back market share for a decade.

TAKE THE INMAN INTEL INDEX SURVEY FOR JULY

For a time, increased FHA premiums made private mortgage insurance the cheaper option for many borrowers. Programs from Fannie Mae and Freddie Mac that allow low-income homebuyers to buy homes with as little as 3 percent down have also helped private mortgage insurers attract more first-time homebuyers.

First-time homebuyers accounted for close to two-thirds (64 percent) of the loans backed by private mortgage insurance in 2023, up from 61 percent in 2022, according to a report released Tuesday by U.S. Mortgage Insurers (USMI).

Close to one in five borrowers (18 percent) who depended on private mortgage insurance to get approved last year made only a 3 percent down payment, up from 11 percent in 2020, the report said.

Seth Appleton

“Without private mortgage insurance, far too many buyers would remain on the sidelines instead of building intergenerational wealth and working towards the American Dream of homeownership,” said USMI President Seth Appleton in a statement.

(USMI is an industry association representing five of the six active U.S. mortgage insurers — Enact, Essent, MGIC, National MI, and Radian.)

After insuring $283 billion in new mortgage originations last year, private mortgage insurers were standing behind close to $1.6 trillion in home loans — including $1.4 trillion in mortgages guaranteed by Fannie Mae and Freddie Mac.

FHA and VA take back market share

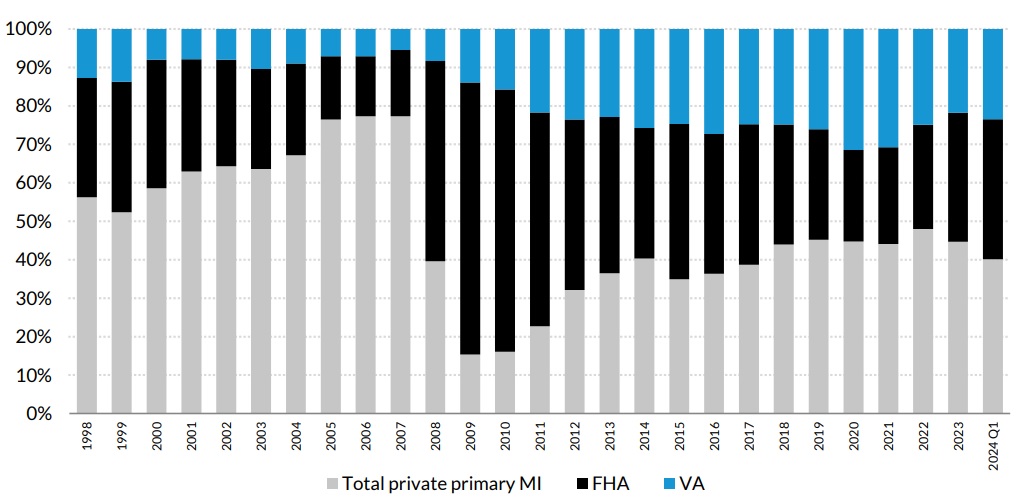

Sources: Inside Mortgage Finance and Urban Institute.

Losses on claims in the wake of the 2007-2009 Great Recession made it difficult for private mortgage insurers to write new policies.

However, after seeing their share of the market for insured mortgages drop below 20 percent in 2009 and 2010, private mortgage insurers gradually reclaimed some of their business from FHA and VA loan programs.

From 2008 to 2013, annual premiums on FHA loans rose from 50 basis points to 135 basis points as the Obama administration coped with losses that led to a $1.69 billion bailout of FHA Mutual Mortgage Insurance Fund in 2013.

Private mortgage insurers steadily grew their share of the mortgage insurance market back to nearly 50 percent in 2022.

But as the economy improved and the FHA program recovered, the Obama administration was able to cut annual FHA premiums by 50 basis points in 2015. Another 30 basis point cut announced by the Biden administration last year made FHA mortgages more attractive than Fannie and Freddie mortgages “for most borrowers putting down less than 5 percent,” according to analysts at the Urban Institute.

During the first quarter of 2024, private mortgage insurers saw their market share drop to 40.1 percent of insured mortgages, down from 47.3 percent in Q1 2023, according to data compiled by Inside Mortgage Finance and the Urban Institute.

Of the $145 billion in mortgages originated with some kind of insurance during Q1 2024, private mortgage insurers still backed the biggest chunk of loans, totaling $58.2 billion.

But FHA’s share of the market grew from 29.9 percent in Q1 2023 — before annual premiums were slashed by $678 million a year — to 36.4 percent in Q1 2024.

Analysts at the Urban Institute calculate that borrowers with a FICO score of less than 740 will find FHA financing to be a better deal when putting 3.5 percent down.

But borrowers with FICO scores of 740 and above will do better taking out a conventional Fannie- or Freddie-eligible mortgage with private mortgage insurance.

Those calculations reflect not only last year’s reduction in FHA premiums but changes to upfront fees that lenders pay when selling mortgages to Fannie and Freddie that were designed to help low- and moderate-income borrowers, the Urban Institute said.

One remaining drawback of FHA loans for borrowers making down payments of less than 10 percent is that the only way to get out of paying mortgage insurance premiums is to refinance out of their FHA mortgages or sell their homes.

Mortgage trade groups have urged the Department of Housing and Urban Development to ditch the “life of loan” premium payment requirement, but so far HUD remains intent on rebuilding FHA’s Mutual Mortgage Insurance fund for the next downturn.

Having slashed annual FHA mortgage insurance premiums by 35 percent last year — and with 2024 FHA loan limits rising to a minimum of $498,257 in affordable markets and up to $1.72 million in high-cost states like Alaska and Hawaii — total insurance in force is growing faster than reserves.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.